“Show me a company valued on EBITDA multiples, and I’ll show you a potential financial time bomb.”

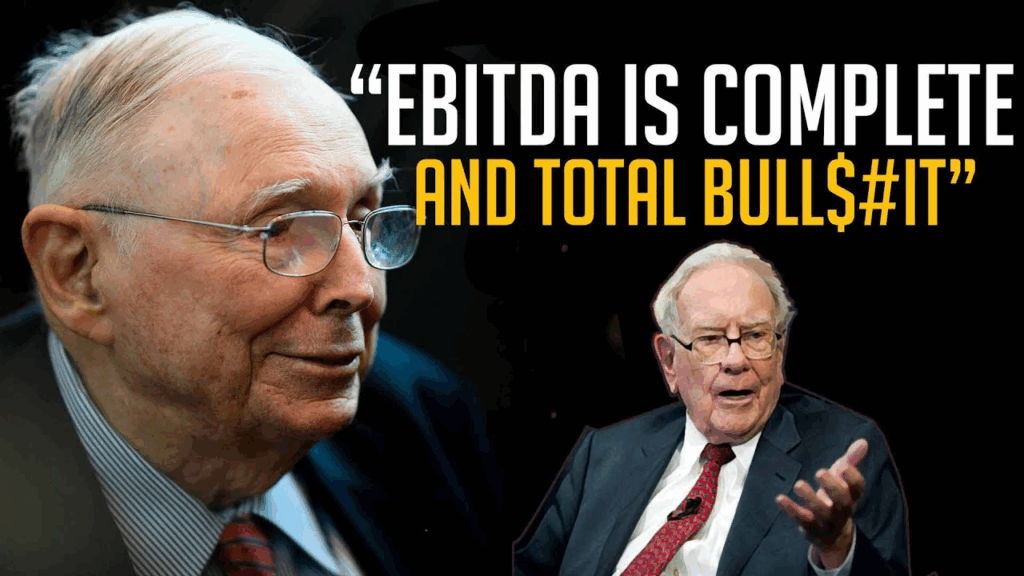

Charlie Munger’s famous condemnation of EBITDA as “bulls**t earnings” wasn’t just colorful language – it was a warning that many business owners and investors continue to ignore at their peril.

The Fundamental Flaw of EBITDA

EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) presents three dangerous illusions:

- The Maintenance Myth

Depreciation isn’t an accounting fiction – it’s the ghost of future capital expenditures. That $500,000 depreciation charge on your machinery? It’s coming due as real cash when you need to replace equipment. - The Tax Mirage

No business operates tax-free. Pretending otherwise is like calculating your household budget while ignoring mortgage payments. - The Debt Delusion

Interest payments don’t disappear because EBITDA ignores them. Ask any leveraged buyout that collapsed under debt burdens.

When EBITDA Becomes Dangerous

The metric goes from problematic to predatory when:

- Used for capital-intensive businesses (manufacturing, transportation)

- Applied to early-stage companies burning cash for growth

- Adjusted beyond recognition (“We add back owner’s salary, office rent, and unicorn acquisition costs”)

Superior Valuation Approaches

1. Owner Earnings: The Buffett Standard

Formula: Net Income + Depreciation – Maintenance Capex

Why it works: Captures true cash-generating ability

2. Free Cash Flow: The Ultimate Reality Check

Calculation: Operating Cash Flow – Capital Expenditures

Example: A “profitable” 2M EBITDA business spending 1.8M annually on equipment isn’t viable

3. Sector-Specific Multiples

- Services: 3-5x Discretionary Earnings (after owner compensation)

- Manufacturing: 4-6x EBIT (accounts for depreciation)

- Tech: Revenue multiples (for pre-profit growth companies)

The Valuation Reality Checklist

Before accepting any multiple:

✓ Verify what’s being excluded in “adjusted” metrics

✓ Calculate replacement capex needs

✓ Stress test under different interest rate scenarios

✓ Compare to actual recent transactions in your sector

Remember: In due diligence, EBITDA multiples dissolve – but cash flow remains. Structure your valuation accordingly from the start.

Leave a Reply